- #Tds accounting entries in tally erp 9 code#

- #Tds accounting entries in tally erp 9 password#

- #Tds accounting entries in tally erp 9 license#

- #Tds accounting entries in tally erp 9 professional#

I run a franchisee computer center, I recommend this book to all my students who come here to learn Tally ERP 9. I run several businesses and this book has come in handy to streamline my inventories on Tally 9 ERP Many unseen features and erstwhile unknown to me I have learnt from this set of manuals. I am a chartered accountant by profession.Ī really useful set of 4 books which highlights the salient features of Tally ERP 9. I would say a must have book for all companies, chartered accountants, and any one who uses tally. You can pay by Depositing the amount by cheque in our ICICI Bank accountįavoring “Kulin Shah” S/B A/C 001801010200 and then sending us an email with cheque details and your Correct Postal Address we will courier the book to you on reciept of the credit amount.Ī must have book for all Tally professionals. Tally.NET, Support Center, Control Center etc

#Tds accounting entries in tally erp 9 password#

Client Installation, Reactivation, Surrender, Reset Password etc.ĥ.

#Tds accounting entries in tally erp 9 license#

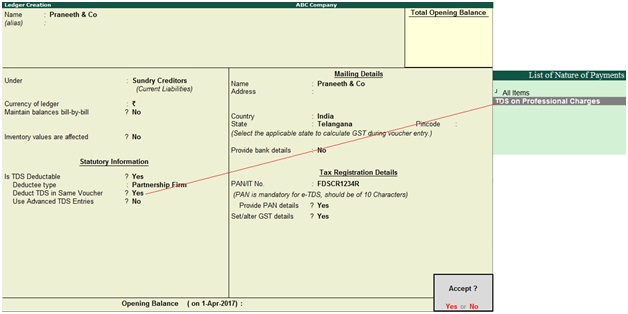

Tally.ERP9 License Single User Installation, Multi user Installation,Ĥ. A Complete Self learning book with exerciseģ. Printed Pages 1080 + Screen Shots of Tally.ERP9.ġ This book is based & written on the latest Release of Tally.ERP9Ģ. Highlights of Tally.ERP9 English Book ( Vol. Learn Tally.ERP 9 from Home Posted: Decem| Author: kulinfx | Filed under: Uncategorized | Leave a comment Note: ESI Eligibility Amount will be as specified in the Stat file. When this field is left blank, the Calendar Period will be taken as the basis for calculation. It is also used to calculate the per day Wages. Note: The Standard Working Days (per month) is used to calculate the ESI gross Amount for a month. Son/Daughter of: Enter father’s for the person responsible for TDS deduction in the companyĭesignation: Specify the official designation of the person responsible for TDS deduction Name of Person Responsible: Enter the name of the person responsible for TDS deduction in the company. Income Tax Circle/Ward: Specify the name of the Income Tax Circle, to which the Employer is associatedĭeductor Type: Select Government for a company belonging to central or statement governments for all others select others. Tax Assessment Number: Specify the 10 digit TAN assigned to the Employer

#Tds accounting entries in tally erp 9 code#

For all other Countries, this option is not available.Īnd Set/Alter Payroll Statutory Details to YesĮnter Company Code as allotted by the PF departmentĮnter Company Account Group Code as specified by the PF departmentĮnter Company Security Code as specified by the PF departmentĮnter Company Code as allotted by the Employee State Insurance Corporation (ESIC)Įnter the number of days to be considered for the calculation of daily wages and monthly Gross amount for ESI benefits as Standard Working Days (per month).

Note: The Payroll Statutory Features are available only for India. Go to Gateway of Tally > F11: Features > F3: Statutory & Taxation

#Tds accounting entries in tally erp 9 professional#

To use the Provident Fund, Employee State Insurance (ESI), Income Tax and Professional Tax features for Indian Payroll, its necessary to enable the Statutory Features for Payroll. It also provides information to the employee as to how the net amount is arrived at.Įnabling Payroll Statutory Features To use the Provident… Posted: Janu| Author: kulinfx | Filed under: Uncategorized | Tags: payroll, tally.erp 9 | Leave a comment Generate the Pay Slip that provides employee as well as attendance details, itemises each component of the employee’s earnings and deductions, and displays the net amount paid to him for a given pay period.

Pass a Payroll Voucher to enter all Earnings and Deductions in payroll transactions that are paid along with the Salary Pay Slip for all employees. Step 5: Process Payroll and Generate Pay Slip Tally.ERP 9 allows creating any complex type of pay head.Ĭreate the applicable Salary Details for both Employee Groups as well as Individual Employees with earnings, deductions and basis of computation. The Pay head creation in Tally.ERP 9 is very user friendly. The components of structured salary are created under Pay Head.Ĭreate the salary structure components in pay head. Create the Attendance/Production Type to record the Attendance and Production details. Enter the requisite Employee Details & Employee Group by grouping employees under the function they perform their department or designation.Ĭreate the Payroll Units. It takes only five easy steps to process payroll and generate Pay Slip in Tally.ERP 9.Ĭreate the Employee masters. The new enhanced Payroll in Tally.ERP 9 requires minimal effort for accurate salary processing.

Five Easy Steps to Generate a Pay Slip Posted: Janu| Author: kulinfx | Filed under: Uncategorized | Leave a comment

0 kommentar(er)

0 kommentar(er)